Silver North Resources Raises C$650k In Non-Brokered PP

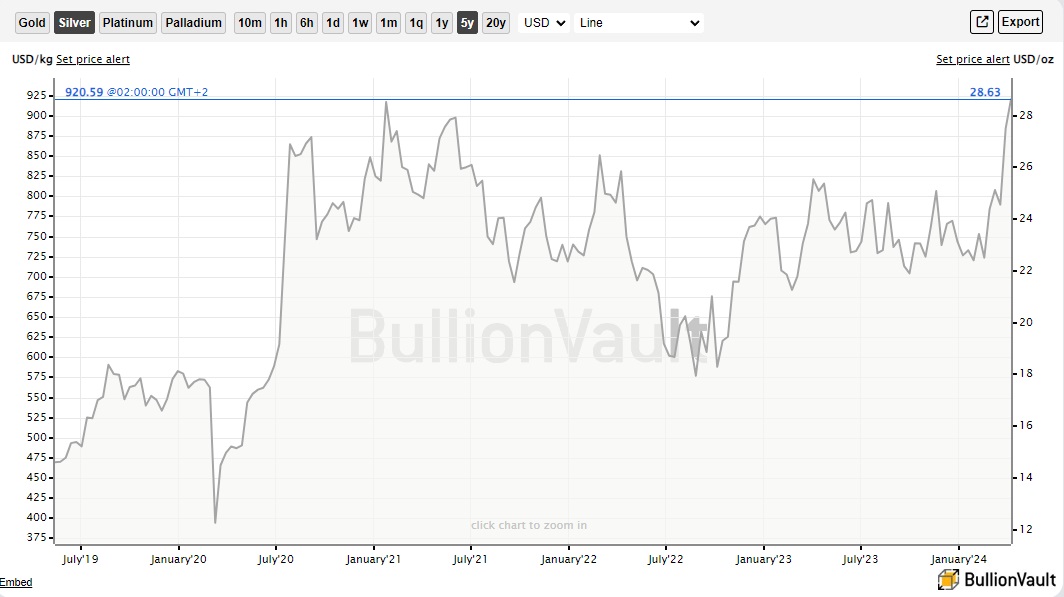

As the Israel-Hamas conflict quickly escalating with Iran’s involvement at the moment, and Russia chipping away diligently at Ukraine’s defences due to outnumbering men and weapons, precious metals are doing very well at the moment. Silver North Resources (SNAG.V), focused on silver, profits from this as the share price doubled from the recent bottom levels, and managed to raise another C$650k to pay the bills and prepare for drill programs at their fully owned flagship Haldane silver project.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

After the name change and roll-back were executed in August 2023, C$815k was raised on October 19, 2023, too late to do the planned autumn exploration because of the upcoming winter break in the Yukon, and not enough to complete a full drill program at Haldane. General mining sentiment was down the drain last year, and only picked up right before PDAC as gold started shattering all-time highs on the war drums in Ukraine and Gaza.

Although war isn’t exactly my favorite catalyst, the rising gold price and copper doing very well on short- and long term shortages could kickstart the next metals bull market in my view.

As silver usually follows gold in some fashion, and certainly is doing so now, this could bode well for Silver North Resources.

The Silver North chart isn’t following suit yet, akin to many other explorers as high metal prices don’t translate directly into high equity prices yet, due to strongly inflated costs in mining:

Share price 3 year period (Source: Tmxmoney.com)

As you can see, Silver North is still completing a bottoming process, but at least has come off rock-bottom levels of 8-10c now, trading around 16c. As always I’m curious about strategy, and since the markets are slowly heating up again I’m wondering if merging with a cash rich shell or junior, potentially with a solid silver asset, could bring sufficient scale in order to raise easier? Or does management feel they can get to a significantly higher market cap in an organic way, by just returning drilling (very) strong results and using an eventual precious metals bull market to their advantage?

He stated: “First of all, any investor in this space should understand that explorers, and especially the early stage explorers get hit the hardest in a downturn and are the last to move in an uptick, but on the other hand have the largest upside potential. Brokers in town were telling me in January and February that the bigger market caps were getting interest from clients, but that was not translating to the small explorecos like us. It is happening now but it is a trickle comparatively. This will change over time if silver remains strong and of course with strong drilling/results etc.

We are always looking for opportunities whether it’s a merger or an acquisition and we have been doing just that through the winter. But the fact is, nothing we have seen on the acquisition side offers the same potential return as Haldane and the effective cost of capital in a merger can be the same as a financing, except it being a much slower process and with the added corporate costs of executing that transaction. Haldane is our bar, and it is the best opportunity to add value through a discovery that we have seen. As this market uptick evolves, the biggest wins an investor will have will be from holding juniors that make new discoveries. This is THE reason to invest in discovery stage companies.

Of course, during a downturn this can be difficult but as we come into a stronger market and capital flows to the earlier stage stories that have been largely ignored, there are some excellent opportunities for investors to benefit from. We have two excellent discovery opportunities at Haldane and Tim and with programs at both of those projects this year we expect to have news flow from May through the rest of 2024 and potentially into 2025, which should provide great support for our share price. The real win is great results that start to prove out our Haldane targets and discovery results from Tim.”

With the C$0.6M already in the treasury, the recently closed financing brought the total cash position to C$1.0M. Silver North has some flow through (~$350k) in the treasury that is earmarked for drilling, but this latest financing is meant for working capital for day to day operations/marketing and any potential acquisitions. With Yukon drilling cost currently at a going rate of C$600-800/m, Silver North doesn’t have the means right now to conduct their intended 2,500m drill program, which really is a minimum for high grade vein drilling at depth (below 200m) in Keno Hills territory.

Earlier this year, Silver North intended to commence drilling before the end of May, when the spring break up had ended and roads would be dry and firm, as always depending on funding. CEO Weber explained to me what his updated plans are with the current treasury, and when he intends to raise more: “With the effective length of our field season (which can extend into winter) we can start later in summer, so we can be flexible with start dates. There isn’t any reason to start earlier, especially since the Tim program will be starting early in the summer. A staggered start works very well for us logistically and has some benefits in terms of financing the Haldane program.”

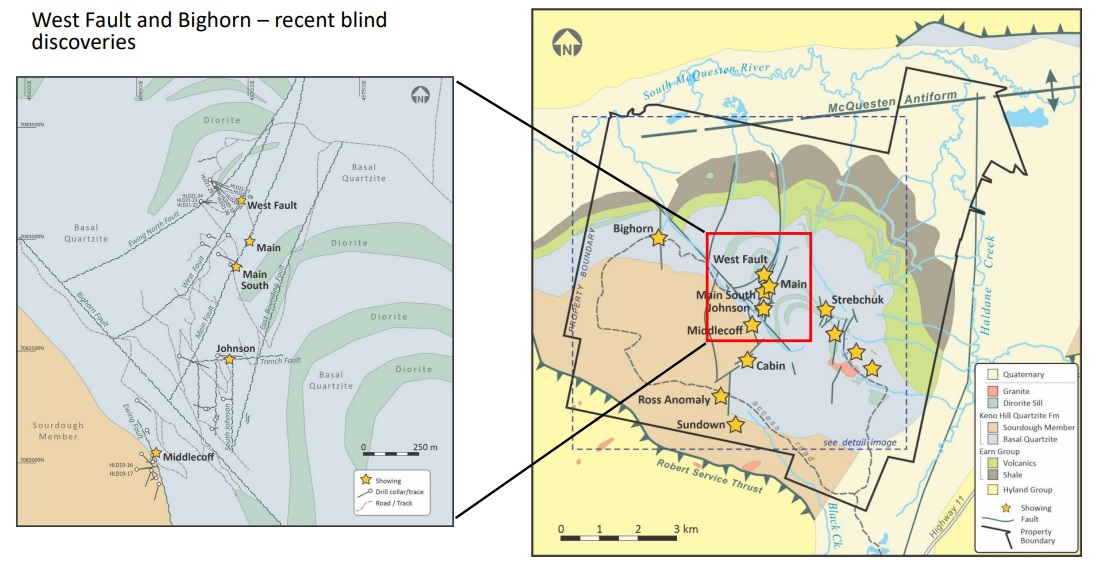

Silver North was planning to target the extensions down plunge on the West Fault target where high-grade silver mineralization has been identified over an area 100 meters by 90 meters in size, and on two structural levels within the West fault structure. If funding permits a larger program, this may also include airborne electromagnetic and magnetic surveys to help map lithologies, refine target structures (strike extensions and offsets) and potentially identify new target structures that may be silver bearing. This work would be followed up by trenching where applicable, and eventually diamond drilling.

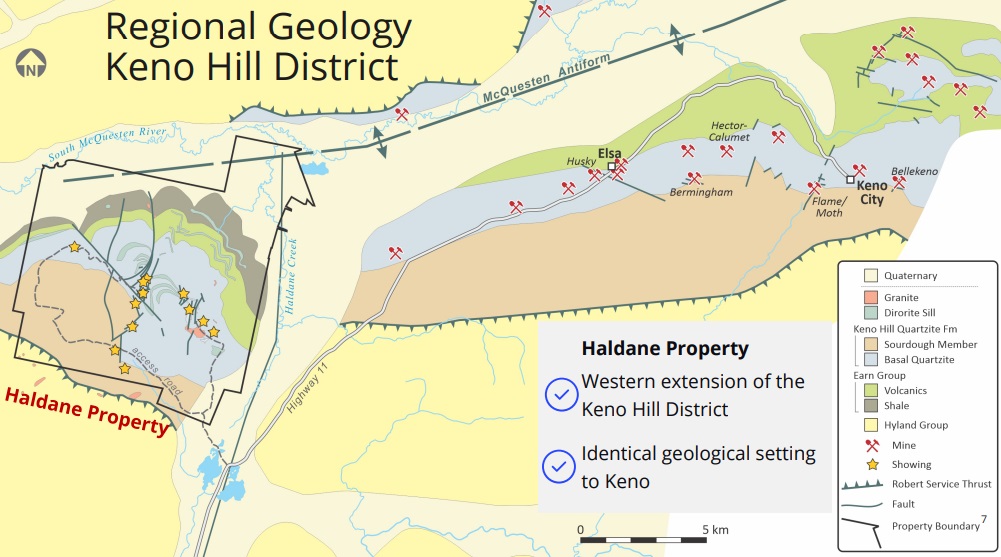

As a reminder regarding Haldane: I have always loved the geological thesis behind this project, as the host rocks of Haldane clearly resemble the geological makeup of the rocks that host the abundance of high grade silver mines and deposits the Keno Hill Silver District is famous for, with the two zones separated by layer of overburden as can be seen on the map below (and potentially even connected below that overburden). According to CEO Weber, he believes there is Keno Hill Mine (Hecla-owned) potential to be found at Haldane, at similar average grades to what is seen elsewhere in the district. With the somewhat recent revelation that these deposits have excellent depth potential for expansion, Haldane (and Keno Hill District targets in general) have the potential for deep mineralization.

Looking more into geological detail: the orientation of the rock units at Haldane varies slightly from the rest of the district, so it might be that a later fault exists between the two areas. Weber also thinks that the grey quartzite may actually be present in certain areas of the overburden-filled valleys (light yellow) considering the quartzite and silver-lead-zinc occurrences showing up on the north side of the valley.

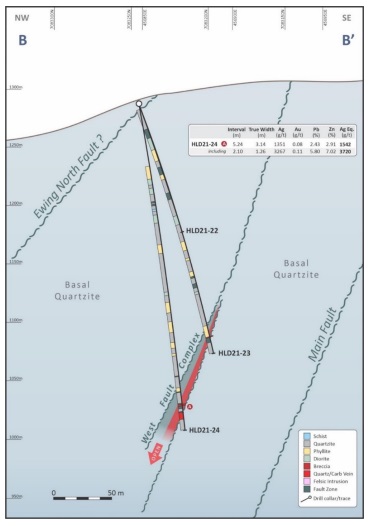

He also believes the quartzite continues below the orange-brownish Sourdough unit, so there is a lot of exploration potential. In general, Yukon Government geologists have mapped the effects of glaciation in this area and describe the glacial advance down the valley from the east, terminating at Mt Haldane. In effect these glaciers have scraped off the weathered rocks in the broad valley that dominates the district, exposing fresh, unoxidized mineralized zones in the quartzite, which could be found, explored and mined easily by the early prospectors. As Mount Haldane towered above the glacier, the weathered rocks are still intact and veins within will be heavily oxidized, causing Silver North to drill through this weathered layer to test fresh sulphide mineralization, with hopefully the same high grade silver beneath it, resembling the rest of the Keno Hill district. This has been born out at Silver North’s West Fault discovery, where the initial shallow drill intersections intersected lower silver grades in well-developed, but highly weathered veins, where deeper intersections hit the same style of veins with high grade silver mineralization.

Drilling would aim to build on previous intersections at West fault including 3.14m @ 1,315g/t silver, 2.43% lead, and 2.91% zinc (true widths), with grades and width increasing at depth. At least four holes were planned to test the extensions of this mineralization on 50m stepouts.

Drilling was also planned for the Bighorn target located 3 kilometers to the northwest of the West Fault. The Bighorn target was identified from soil geochemical sampling that returned anomalous values for lead and silver in soils. The only drill hole at this target returned 125.7 grams per ton silver and 4.39% lead over 2.35 metres from previously unrecognized vein structures. Trenching and groundwork in 2022 programs was able to refine targeting at Bighorn, and additional drilling will test this target for its potential to host wide, high grade silver mineralization. Additional drilling will also target the Main and Middlecoff targets, and any targets generated from the geophysical data and trenching.

An interesting development is that Hecla Mining reached commercial production at their nearby Keno Hill silver mine in Q4, 2023, achieving 1.5Moz Ag for FY2023, having solved the mining/milling issues that plagued new acquisition Alexco. The AISC is forecasted to be US$13.50-16.75/oz Ag, which is solid at a current silver price of US$28.5/oz Ag, and will likely come down more this year, as Hecla aims at ramping up to nameplate production, which could come in at an estimated 2.5-3 Moz Ag/pa. This opens up potential for Silver North to work on a resource at Haldane, capable of being trucked to Hecla’s Keno Hill mine, drastically reducing capex.

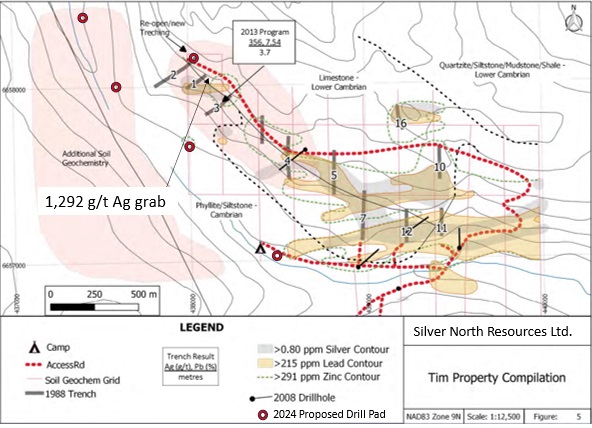

Besides Haldane, Silver North owns the Tim property, subject to an earn-in agreement with Coeur, which can earn a 51% interest in the Tim Property by completing all exploration expenditures and cash payments due by December 31, 2026, which will total at least C$3.55M and C$425,000 in cash payments. Coeur can bring its interest up to 80% by making additional cash payments of C$100,000 per year, completing a positive feasibility study and informing Silver North by December 16, 2028, of Coeur’s intention to develop a mine on the property. Coeur is the project operator and is currently In the final stages of planning the 2024 program, laying out a 2,000 metre campaign with drillholes from up to six pad locations.

Coeur is committed to a $700,000 program, consisting of mostly fairly shallow drilling as they will likely test down dip from surficial showings. With their existing infrastructure at Silvertip, only 19 km away by road, they expect the drilling costs to be relatively low, and they are eager to apply the knowledge and expertise gained at Silvertip to make a new high grade silver discovery at Tim.

As Silver North had also shortlisted M&A and property acquisition favourites during the winter, I was wondering if CEO Weber had potential candidate projects on his radar, in order to expand their silver portfolio. He told me that there are some strategic target acquisitions that they are working on that they are hopeful that can be completed in the near to mid term.

Since Silver North is trying to divest Stateline and Klondike since the change in direction, and as sentiment is turning, I was wondering what the current state of affairs is. Are there more potential suitors kicking tires? CEO Weber elaborated: “I think the sentiment is changing but resource-stage projects (or near resource stage) are the still the most sought after targets. It will take some time before that trickles down to discovery stage projects so I wouldn’t say we have seen much change at this point.”

Conclusion

Hopefully we will have a precious (and other metals) bull market on our hands from now on, and the company will be able to raise more during the summer, enabling them to complete funding for the planned 2,500m program or maybe even more. Let’s see if their work could entice investors, maybe even somewhat akin to what recently happened to other client Vior, where a rewarding pile of money, larger than their market cap at the time, was raised based on a few years of hard, high quality preparation work, not unlike Silver North has done.

On the other hand Silver North has the option agreement with Coeur on their Tim Silver project, with Coeur having commenced drilling, with results coming out later in the summer. Let’s see what this summer can bring for this tiny silver junior. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in Silver North Resources and Vior. Silver North Resources and Vior are sponsoring companies. All facts are to be checked by the reader. For more information go to www.silvernorthres.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Mt Haldane

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.